interest tax shield formula

Interest expenses via loan and mortgages are tax deductible meaning they lower the taxable income. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

Interest Tax Shield Formula And Excel Calculator

This is equivalent to the 800000 interest expense multiplied by 35.

. Tax Shield 45. Gross Profit 20 million 6 million. Thus Taxable Income declined from 1000 to 955.

Interest tax shields refer to the reduction in the tax liability due to the interest expenses. The tax shield computation is represented by the formula above. Tax_shield Interest Tax_rate.

Ad TaxInterest is the standard that helps you calculate the correct amounts. 1 For example because interest on debt is a tax-deductible expense taking on debt creates a tax shield. And this net effect is the loss of the tax shield value but again of the original expense as income.

The interest tax shield is an important consideration because interest expense on debt ie. Interest Tax Shield 109375 Interest Tax Shield Formula The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below. If you wish to calculate tax shield value manually you should use the formula below.

In such a case one needs to add back the after-tax interest expense to the income. A formula to calculate after-tax interest expense is interest expense 1 Tax. This income reduces the taxpayers taxable income for a given year or defers income taxes into future periods.

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. Lets understand this with the help of an example of a convertible bond.

This is very valuable to companies. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. Therefore the companys gross profit equals 14 million.

Easily Project and Verify IRS and State Interest Federal Penalty Calculations. In such a case the tax shield is computed as follows. These deductions help the taxpayer to reduce their.

In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the following example. Tax Shield 30015. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

Now lets look at the impact that having debt has on the organizations Income statement which is going to take the form of the interest tax shield. Tax shield approach refers to the process of the amount of reduction in taxable income for a corporation or individual achieved by claiming allowable deductions like medical expenses amortization loan or debt mortgage interest depreciation and charitable donations. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a tax rate of 15.

Depreciation Tax Shield Formula. Definition of tax shield. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

As such the shield is 8000000 x 10 x 35 280000. Interest Expense 0 million. Interest Tax Shield Interest Expense Tax Rate.

Tax Rate 20. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Interest Expense 20000.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. What is the formula for tax shield. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation amortization and depreciation.

1 Since a tax shield is a way to save cash flows it increases the value of the business and it is an important aspect. The cost of borrowing is tax-deductible which reduces the taxes due in the current period. In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense.

For instance we are looking at Bear company that has a 35 tax rate. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

Interest Tax Shield Interest. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. Companies pay taxes on the income they generate.

The interest tax shield can be calculated by multiplying the interest amount by the tax rate. How to Calculate a Tax Shield Amount. Thus interest expenses act as a shield against the tax obligations.

Tax rate 35. Interest Tax Shield Formula.

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

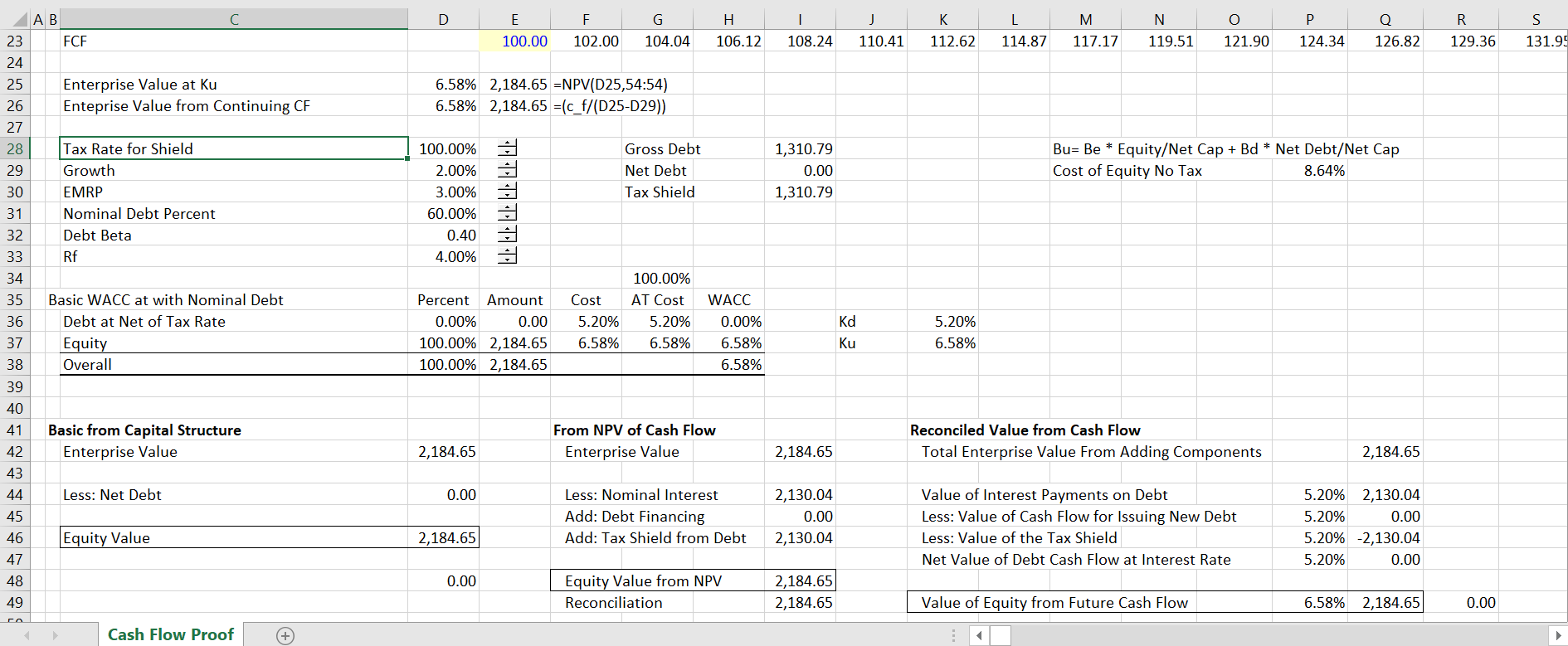

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

What Is A Tax Shield Depreciation Tax Shield Youtube

Modigliani And Miller Part 2 Youtube

Depreciation Tax Shield Formula And Excel Calculator

Adjusted Present Value Apv Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example